I posted earlier this week on the developing Income Trust scandal (ITScam) and described nine funds that suspicious trading activity the day before of the day of Ralph Goodale’s policy announcement on Income Trusts at 6pm (2 hours after market close).

Some point to a Bloomberg article posted at 4:14pm on November 23rd that provides a bang-on prediction (or dissemination) of Ralph Goodale’s announcement. The article shows that people did know of the details of Goodale’s announcement before it was made. The article was published to the public 14 minutes after market close yet, from my data, the evidence shows that the market experienced considerable volume from buyers that were supposed to be in the dark at that moment of time. At its worst, the article (regardless of what time it was published) shows that someone was in the know and sourced the Bloomberg article.

As the following data will show, if the information was truly public, we would have seen a considerable increase of trades along with volume. My previous data does show a large, and unusual, surges in volume prior to Goodale’s announcement. The question I look to answer here is this: Does the data show that the volume is indicative of publicly available information, or were only a select number of individuals aware of the details of the finance minister’s announcement?

My speculation:

(Click any graph to enlarge it)

Richards – shows full market reaction to income trust announcement. Notice high volume and low trades prior to Goodale’s announcment. Is this indicative of insider information?

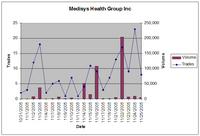

Medisys – shows relatively high number of trades on the 24th (after announcement). Shows about the same number of trades on the 3rd in comparison to the 22nd. However, the 3rd saw the movement of 37,280 units in 18 trades (average of 2,071 units per trade). Compare that to the 22nd where 203,953 units moved hands in 17 trades (average 11,997 units per trade).

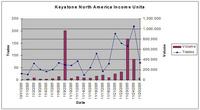

Keystone – This fund was obviously reacting to other variables not affecting the other funds under study as volume the number of trades for this fund on the 21st, the 22nd and 23rd were all higher than usual. However, on the 23rd when a considerable volume of shares traded hands, a lesser number of trades moved 804,843 shares than moved 158,400 shares the day before. Notice too that the price climbs as a reaction to a considerable number of buy orders prior to Goodale’s announcement.

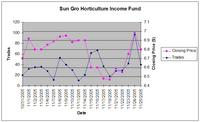

Sun Gro – This fund shows a huge volume of shares traded by relatively few transactions. We can see from the price-trade graph that the real value of this particular income trust was assessed the when traded resumed on the 24th after Goodale’s announcement on the 23rd (similarly here, here, and here). Note the difference in volume on the 22nd compared to the 24th. Compare also the number of trades between these two days. A few traders bought a lot of shares on the 22nd, while on the 24th, after the rest of the world knew the real value of income trusts (after the announcement), the asking price went up and so did the number of trades.

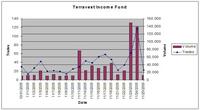

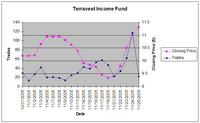

Terravest – This fund shows a significant volumes of shares traded by a small number transactions on the 23rd, while the number of trades on the 24th represents global knowledge of the Income Trust announcement.

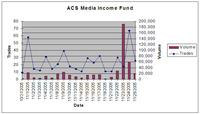

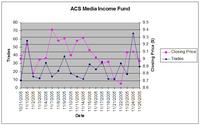

ACS – Massive volume on the 23rd (price rises – people buying). However, only a few people are buying up all of these shares. The closing price reflects the buying on the 23rd and is relatively stable on the 24th as many many more trades are made.

Two exceptions:

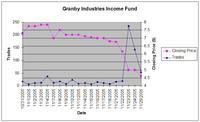

Granby – On further analysis this fund, while showing a huge volume on the 23rd, is probably not linked to the Income Trust scandal. The volume on the 23rd was actually a major sell-off, whereas anyone with advanced knowledge of Goodale’s announcement would be buying Income Trusts. Note that the number of trades corresponds well with the volume. This is indicative of what normal trading looks like (ie. with information public to the market community)

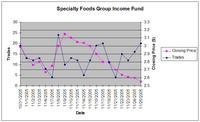

Specialty Foods – This fund might also be removed from the pool of funds potentially linked to ITSCAM. This value of this fund did not receive any benefit from Goodale’s announcement as the price declined steadily. The massive spike in volume on the 23rd cannot be explained at this time. It is likely that other factors independent of Goodale’s announcement were affecting the price.

Preliminary conclusions:

- Thousands upon thousands of stocks, funds, trusts etc. are traded upon the world’s markets everyday.

- In the realm of Canadian income trusts, 9 trusts showed unusual trading activity either the day before or the day of Goodale’s income trust announcement. Goodale made the announcement after the market closed.

- Of these 9 trusts, 6 showed massive (and very unusual) volumes prior to Goodale’s announcement, showed a massive “buy” preference, and showed relatively few transactions.

- Relatively few transactions (trades), massive volumes of purchases, and sustained profit (later increased value of trusts due to Goodale’s announcement) strongly suggests insider trading as publically available data immediately results in a finely adjusted and realistic asking price, which in turn has an effect on volume and number of transactions.

- If, for example, I knew that Goodale’s announcement would increase the value of income trusts (and nobody else knew), the asking price wouldn’t affected and I could buy a considerable number of shares (high volume, low number of trades). In the counter example, if everyone knew that the value of income trusts increased, the asking price would go up. Because the knowledge is global, this increases the potential number of trades.

If you’ve got anything to add (or any corrections), please post in the comments section.